Behind the Scenes of LP Optimization

A brief dive into Dynamic Liquidity Market Makers and their strategic optimization

During our recent development of a liquidity provision bot for Solana's Dynamic Liquidity Market Makers (DLMMs), we discovered significant advantages in targeting specific bins when adding liquidity—a capability that Meteora's standard UI doesn't directly expose, though their SDK makes it possible.

To address this gap, we've built and released a lightweight DLMM Position Manager that allows more granular control over LP positions created on the Meteora DEX:

Understanding Liquidity Market Makers: CPMM vs CLMM vs DLMM

Before diving into our tool, it's worth understanding the evolution of DEX liquidity models and why bin-specific targeting in DLMMs is valuable. Let's compare the key models:

1. Traditional AMMs (CPMM) → Continuous liquidity, smooth IL curve

The classic Automated Market Maker model used by Uniswap V2, Sushiswap, etc. uses the constant product formula:

ILCPMM ≈ ½ (△P/P)² · Pmax - Pmin/P

While simple and capital-efficient across the entire price range, CPMMs suffer from suboptimal capital allocation since liquidity is spread evenly across all price points, including those far from the current trading range.

2. Concentrated Liquidity (CLMM) → Piecewise IL, higher efficiency but risk of total IL if price exits range

Introduced by Uniswap V3, concentrated liquidity allows LPs to specify price ranges for their capital. This increases capital efficiency but introduces more complex impermanent loss dynamics:

- Higher capital efficiency (10-100x) within the specified range

- Risk of zero returns if price moves outside your position's range

- Requires more active management to maintain optimal positions

| Factor | Traditional AMMs (CPMM) | Concentrated LMMs (CLMM) |

|---|---|---|

| Liquidity Range | 0 → ∞ (Uniform) | Custom Price Range |

| Capital Efficiency | Low | High |

| IL Behavior | Gradual Loss | More Severe if Price Leaves Range |

| LP Fees | Lower | Higher (While in Range) |

| Risk of Being "Stuck" | No (Always 50-50 mix) | Yes (100% One Asset When Out of Range) |

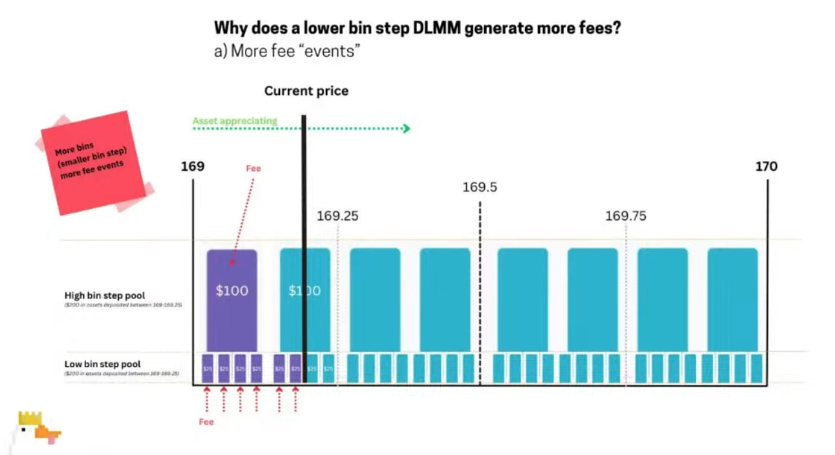

3. Dynamic Liquidity (DLMM) → Step-function IL, lower slippage but higher bin-rebalancing costs

The newest evolution, implemented by Meteora on Solana, uses a binning system to provide even more granular control:

ILDLMM = ∑i=1n ILbin · 𝟙(P crossed bin i)

Where 𝟙(P crossed bin i) is an indicator function that triggers IL when the price crosses a bin.

This model offers several advantages:

- Step-function IL, allowing for more predictable impermanent loss calculation

- Lower slippage for traders within active bins

- Higher bin-rebalancing costs, which need to be carefully managed

"In addition, DLMM allows for single-sided asset deposits, so LPs can deposit only one token in the pool to DCA (dollar cost average) to the other token in the pair. Single-sided asset deposits are also suited for token launches, where the project only deposits their token in the pool first so users can purchase their token with USDC or SOL when the pool starts trading." - Meteora Docs

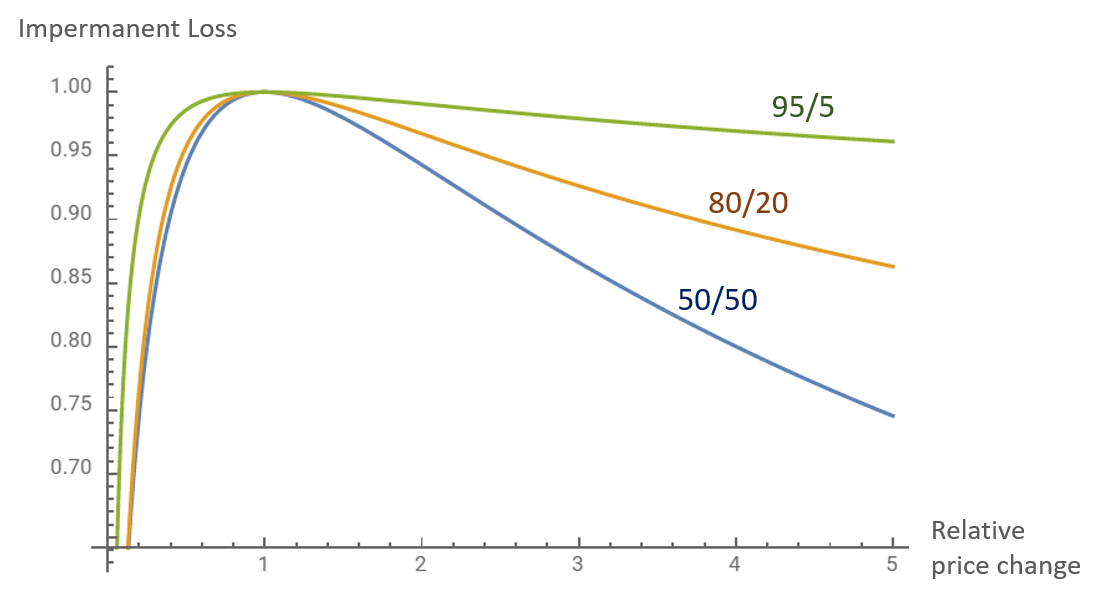

Technical Deep Dive: Impermanent Loss Mathematics

Nonlinear IL Dynamics: Impermanent loss in AMMs follows a nonlinear pattern. For a standard 50:50 CPMM pool, the exact formula is:

IL(p) = 1 - (2√p)/(p+1)

Quadratic Approximation: For smaller price movements (within 10-20%), we can approximate IL using a Taylor expansion:

IL ≈ ½(△P/P)²

This reveals that IL grows at half the rate of the square of the relative price change — explaining why even modest price volatility can significantly impact returns.

CLMM Equation: Within an active range [plow, phigh], IL in concentrated liquidity models can be expressed as:

ILCLMM(p) = 1 - (2√p·(√p-√plow))/((p+1)(√phigh-√plow))

Out-of-Range Lock-In Risk: When price moves outside your set range in a CLMM, IL becomes locked at the boundary value, and your position converts to being entirely in one asset. Without dynamic management, this frequently leads to underperformance compared to simple buy-and-hold strategies or even traditional CPMMs.

Visual Comparison of Impermanent Loss Models

To better understand how impermanent loss manifests differently across market maker models, let's visualize the IL curves for each approach:

CPMM (Traditional AMM)

Traditional AMMs have a smooth, continuous IL curve with losses growing quadratically as price deviates from entry point.

CLMM (Concentrated)

Concentrated liquidity has steeper IL within range but caps losses when price moves outside the position range, creating a piecewise function.

DLMM (Discrete Bins)

DLMMs experience IL as discrete steps at bin boundaries, allowing for more precise risk management through targeted bin placement.

The step-function nature of DLMM impermanent loss means that total IL equals the sum of individual bin ILs when price crosses their boundaries. This creates opportunities for strategic bin selection to minimize IL while maximizing fee capture.

Why We Built the DLMM Position Manager

While working with Meteora's DLMM on Solana, we encountered several challenges:

- The official UI doesn't allow direct bin targeting for liquidity provision

- Calculating optimal bin placement requires analyzing historical price action and volatility

- Managing rebalancing costs against earned fees demands precise timing

Our DLMM Position Manager addresses these issues by offering:

- Direct bin selection and liquidity allocation

- Integration with your own RPC endpoint (works with free tier services like Helius or QuickNode)

- Built-in queuing and rate-limit handling to work with restricted RPC endpoints

- Wallet connection for seamless transaction execution

Variable Analysis & Impact on LP Performance

Our research revealed several key variables that impact DLMM liquidity provision performance:

| Variable | Controllable? | Impact |

|---|---|---|

| Bin Step (w) | Yes ✓ | Higher (w) → Fewer rebalances, but higher IL |

| Liquidity Share (k) | Yes ✓ | Higher (k) → More fees, but higher swap costs |

| Base Fee (γ) | Yes ✓ | Higher (γ) → More earnings per trade |

| Bin Range (r) | Yes ✓ | Wider range (r) → Fewer rebalances, but lower l(k) |

| Price Volatility (σ) | No ✗ | Higher (σ) → More rebalancing |

| Trading Volume (V) | No ✗ | Higher (V) → More fees, improves profitability |

| Slippage (φ) | No ✗ | Higher (φ) → More costly rebalancing |

Key Lessons from Our LP Strategy Development

While building and testing our strategies across Solana, Sui, Sonic, Berachain, and Ethereum ecosystems, we've learned several important lessons:

Timing Is Everything

Early entry into new protocols consistently yields the highest APYs. As more liquidity floods in, returns normalize rapidly. The golden window for extraordinary returns typically lasts a few months after a new protocol launch and a few weeks after a new trading pair is created (the more meme the shorter the window).

Volume Trumps APY Projections

Always prioritize pairs with consistent trading volume over flashy APY projections. Strong, sustainable volume provides more reliable returns through trading fees.

Bin Selection Impact on Profitability

The discrete nature of DLMMs creates a unique IL calculation dynamic where each bin crossing represents a distinct IL event. Unlike CLMMs where IL is continuous across a range, DLMMs allow for more granular risk management:

- Summed Bin IL: Total IL in a DLMM equals the sum of IL from each bin the price crosses, making targeted bin placement a powerful optimization lever

- Quadratic Risk Growth: Like traditional AMMs, each bin's IL still follows a quadratic relationship to price movement, meaning risk increases non-linearly with position size

- Rebalancing Optimization: The ideal rebalancing strategy must balance transaction costs against the step-function IL curve unique to DLMMs

The Narrow Path to Profitability

Our testing revealed that profitable LP strategies exist only within a very narrow and well-tuned set of variables:

- Optimal bin range selection based on recent volatility

- Fee settings that balance attractiveness to traders against your earnings

- Rebalancing thresholds that minimize transaction costs

Under these conditions, it's possible to break even and eventually edge past the quadratic IL vs. fee curve—but it requires careful optimization and monitoring.

Key DeFi Risks and Mitigation Strategies

Before concluding, it's worth highlighting the key risks in DeFi and how providers can mitigate them:

| Risk Category | Examples | Mitigation Strategies |

|---|---|---|

| Financial Risks | Impermanent Loss, Slippage | Tight ranges for stable pairs, active rebalancing, hedging with derivatives |

| Technical Risks | Smart contract exploits, Oracle manipulation | Protocol diversification, limiting exposure to newer/unaudited platforms |

| Operational Risks | Rug pulls, Centralization risks | Due diligence on teams, preferring established protocols with proven track records |

| External Risks | Regulatory uncertainty, MEV exploitation | Staying informed on regulatory developments, using private transaction pools |

LP Strategy Considerations

Different LP strategies offer distinct risk-reward profiles:

- Tight Range Strategy: High fee capture but requires frequent rebalancing (e.g., stablecoin pairs at $1 ± 0.01)

- Wide Range Strategy: Lower IL impact but less efficient fee generation (e.g., volatile pairs with 20-30% price range)

- Active Rebalancing: Using automation to dynamically adjust positions based on volatility patterns

- Cross-Protocol Hedging: Offsetting position risks using derivatives or correlated assets

Looking Forward: Advanced Algorithms and Risk Management

While our current DLMM Position Manager was a good starting point for DLMM liquidity provision, we've been exploring more advanced approaches to improve the bot:

- Mean-reversion based bin placement strategies

- Volatility-adjusted dynamic range setting

- Multi-pool hedging to minimize directional exposure

We've also been watching projects like HawkFi.ag on Solana, which offers interesting approaches to automated risk management for LPs. If trading volume returns to higher levels, tools like these could become essential components of profitable LP strategies.

Further Resources

For those who want to dive deeper into understanding DLMMs, impermanent loss, and LP strategies, here are some valuable resources:

- Meteora Documentation - Comprehensive guide to Meteora's DLMM system

- Impermanent Loss in Uniswap V3 - Analysis of IL in concentrated liquidity positions

- Academic Analysis of AMM Models - Research on AMM design and efficiency

- Why do half of Uniswap v3 users lose money? - Analysis of LP profitability challenges

- Meteora Bootcamp Resources - Training materials for LP strategies

Conclusion

DLMMs represent a fascinating evolution in DEX architecture, offering new opportunities for LPs willing to dive into the technical details. Our DLMM Position Manager aims to make these opportunities more accessible while still using an easy-to-use UI instead of the SDK, but remember—there's no free lunch in DeFi. Successful LP strategies require careful analysis, constant monitoring, and realistic expectations.